Investing summary 2018 October + November

The biggest change in my portfolio since the last investing summary, is the first repayment from Crowdestate. My online portfolio right now consists of:

- p2p real estates (Crowdestate)

- p2p loans (Mintos)

- Shares, Bonds & ETFs (Degiro)

With addition of Crowdestate to the portfolio I now cover the major investment fields. I was considering joining real estate sector for some while now. I didn’t want to go and buy a household on my own, as it would require a huge amount of money and decades of paying the mortgage. The real estate market is still very high and I wanted to participate in it in with smaller amount of money. Mintos would be the best option probably, but the amount of real estates loans (mortgages) there is pretty limited.

The first time I heard about Crowdestate was on Cashflow Summit, held in Olomouc in Spring. It sounded like it could cover my needs of real estates investment. Decent amount of new investment opportunities (typically 1-2 per week right now), with solid analysis and description of the project. Yields around 11-16% p.a. and the maturity of projects raging from 3 months to 4 years. Crowdestate also has autoinvest option, however I am not using it yet, as I like to read about the projects first. It might change later, as I will get more familiar with the whole process.

Loans p2p – Mintos summary

| Year | Month | Account balance [€] | Investments | Deposit | Earnings [€] | ROI p.a. [%] | ROI p.m. [%] |

| 2018 | June | 1272,6 | 146 | 12,81 | 12,20 | 1,02 | |

| 2018 | July | 1286,34 | 122 | 13,74 | 12,96 | 1,08 | |

| 2018 | August | 1296,11 | 143 | 9,77 | 9,11 | 0,76 | |

| 2018 | September | 2008,71 | 218 | 700 | 12,6 | 11,67 | 0,97 |

| 2018 | October | 2021,94 | 224 | 13,23 | 7,9 | 0,66 | |

| 2018 | November | 2041,17 | 233 | 19,23 | 11,41 | 0,95 |

There was a significant decrease in Mintos ROI in October. Even though I wasn’t happy about this, Mintos at least made sure, all investors were informed about it through email. Mogo, one of the main loan originators (at least in my strategy) got a new source of funding. They released their own corporate bonds. These bonds were big success for Mogo and raised a lot of money (50m €). With this money they went to Mintos and prematurely repaid the majority of the high yield loans. So a lot of my loans were finished immediately, with some instant gain, but much less than I would get if they were repaid in a standard way. What Mogo did after is clear, they reposted all these loans back to Mintos, however with lower yield. In some case the loans went from 12% p.a. to 8% p.a. At that moment I had several hundreds euros in my Mintos wallet, doing nothing and there weren’t that many interesting loans I would like to invest in.

TOP 5 Mintos loan originators

With this in mind I was looking for a different loan originators, who could fill the gap after lucrative loans of Mogo were gone. I managed to find a new promising ones. My main loan originators currently are:

- Hipocredit

- Aasa

- Creditstar

- ID Finance

- Mogo

As you can see, Mogo is still in my TOP 5 originators on Mintos. Except that their loans offer slightly lower interest now, they are still great, and at least comparable with the others. Also if 50m euro were borrowed them from major investor companies through bonds, they are probably quite stable.

Anyway, as I reorganised my autoinvest rules a bit, I am realistically looking for a little bit lower yields. Days of 13% are gone and I am aiming for 10-11% p.a. on average. I feel like it suits my investment personality much more. Stability over chasing for extra high yields.

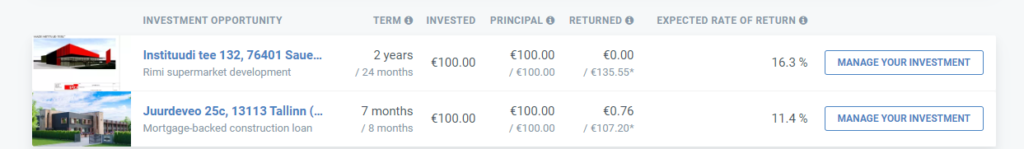

Real estate p2p – Crowdestate summary

I already wrote about Crowdestate in the beginning of this investing summary. Even though I only invested in few projects so far, I already got my first payments back. The minimal investment is 100€ which is bit more, than on Mintos (10€), but I can understand, why is it higher. Typical loan on Mintos is between 100-5000€, so not that much investors needed. Whereas on Crowdestate, the loan amounts are much bigger 100 000 – 1 000 000 €, it’s real estates after all. So they also had to scale the minimum investment.

Personally, I don’t mind. I still choose carefully the whole description of the project, before investing. That is important thing, that Crowdestate isn’t just dropping new projects into the system, but they also analyse them quite intensively before. It’s usually 2-5 pages of very nicely structured analysis of the investment opportunity. It includes a General description of the project, SWOT analysis, Repayment schedule, Capital structure, Crowdestate rating and many others. Overall, I love this analysis, that it’s not just about “give us your money, we know what to do with them”. Overall, Crowdestate feels professional.

Shares and ETF at Degiro

Moving to the last section of my investing summary – Shares, ETF and Bonds. I started my account at Degiro broker. So far I can’t say anything bad about this broker, as I hasn’t been much active. I did my first way of buying few stocks back in September/October and since then I didn’t do anything, as I want this to by very passive way of investing. I will put money aside every month and than once a 3-6 months I will buy a higher amount of stocks I decided to go in my strategy. And that’s it. Financial books say, the hardest thing is to stick to your strategy, when the markets are going up and down. I will simply observe my feelings in those times and will know more. As far as I can say, Degiro is a safe choice for choosing financial broker. Low fees and wide selection of shares. Some of them are free of charge, if you would like to try investing small amounts into start ups and smaller companies.

Leave a Reply